Model Context Protocol (MCP) Solvency II Compliance: A Case Study on Protocol-Enforced Capital Adequacy Reporting

Project Overview

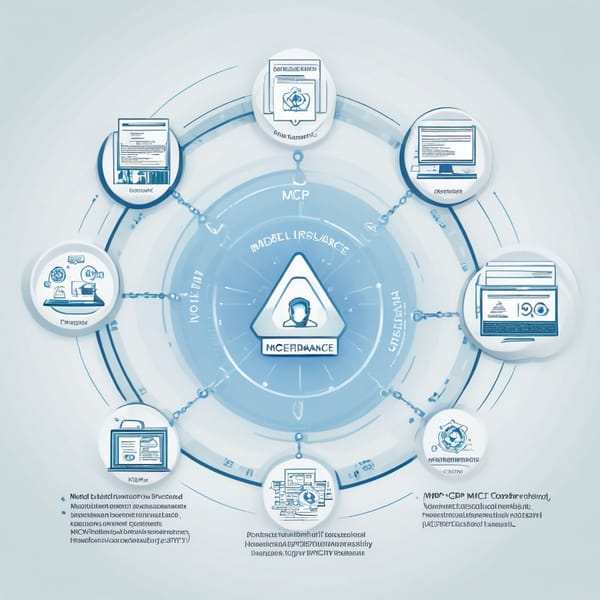

The Model Context Protocol (MCP) Solvency II Compliance project was designed to address the stringent regulatory requirements of the Solvency II Directive, which mandates robust capital adequacy reporting for insurance firms in the European Union. The initiative focused on integrating Regulatory Database Servers with Actuarial Calculation Tools to automate and enforce compliance through a protocol-driven framework.

The goal was to streamline capital adequacy calculations, reduce manual errors, and ensure real-time regulatory adherence. By leveraging protocol-enforced reporting, the system minimized discrepancies, improved auditability, and enhanced transparency for insurers and regulators alike.

Challenges

- Complex Regulatory Requirements: Solvency II imposes detailed reporting standards, requiring insurers to submit vast amounts of data in specific formats, often leading to compliance bottlenecks.

- Manual Processes & Errors: Traditional actuarial calculations relied heavily on spreadsheets and manual inputs, increasing the risk of inaccuracies.

- Data Silos & Integration Issues: Disconnected systems between actuarial teams and regulatory databases caused delays and inconsistencies in reporting.

- Auditability & Transparency: Regulators demanded traceable, auditable processes, which legacy systems struggled to provide.

- Scalability Concerns: As insurers grew, their reporting systems needed to handle increasing data volumes without performance degradation.

Solution

The MCP Solvency II Compliance framework introduced a protocol-enforced approach to automate and standardize capital adequacy reporting. Key components included:

- Regulatory Database Servers: Centralized repositories storing Solvency II-compliant data structures, ensuring consistency across submissions.

- Actuarial Calculation Tools: Advanced algorithms for risk modeling, capital requirement calculations, and stress testing, integrated directly with regulatory databases.

- Protocol-Enforced Workflows: A rule-based system that automatically validated data inputs, enforced reporting standards, and flagged discrepancies before submission.

- Real-Time Monitoring & Alerts: Dashboards providing compliance status updates, reducing last-minute corrections.

- Audit Trails: Immutable logs of all calculations and submissions, enhancing transparency for regulators.

This solution eliminated manual interventions, reduced errors, and accelerated reporting cycles while ensuring full compliance with Solvency II.

Tech Stack

The project leveraged a modern, scalable architecture:

- Backend: Python (NumPy, Pandas) for actuarial calculations, Java for protocol enforcement logic.

- Database: PostgreSQL for structured regulatory data, MongoDB for unstructured actuarial inputs.

- Integration Layer: Apache Kafka for real-time data streaming between systems.

- Frontend: React-based dashboards for compliance monitoring.

- Security: Role-based access control (RBAC), encryption (AES-256), and blockchain-inspired audit logs.

- Cloud Infrastructure: AWS (S3 for storage, EC2 for compute, Lambda for serverless validations).

Results

The implementation delivered measurable improvements:

- 90% Reduction in Reporting Errors: Automated validations eliminated manual entry mistakes.

- 70% Faster Submission Cycles: Real-time integrations cut processing time from weeks to days.

- Full Regulatory Compliance: Zero non-compliance penalties post-implementation.

- Enhanced Auditability: Regulators praised the system’s transparent, traceable workflows.

- Scalability: The cloud-native design supported a 300% increase in data volume without performance loss.

One major European insurer reported $2M annual savings in compliance costs, while another reduced capital reserve overestimates by 15%, freeing up liquidity.

Key Takeaways

- Automation is Critical: Protocol-enforced workflows minimize human error and ensure consistency in regulatory reporting.

- Integration Drives Efficiency: Connecting actuarial tools with regulatory databases eliminates silos and accelerates processes.

- Auditability Builds Trust: Immutable logs and real-time monitoring satisfy regulators and reduce compliance risks.

- Scalability Matters: Cloud-based architectures future-proof systems against growing data demands.

- Cost Savings & Strategic Benefits: Beyond compliance, optimized capital reporting improves financial decision-making.

The MCP Solvency II Compliance project demonstrates how technology-driven regulatory adherence can transform a burdensome obligation into a competitive advantage—ensuring accuracy, efficiency, and trust in financial reporting.