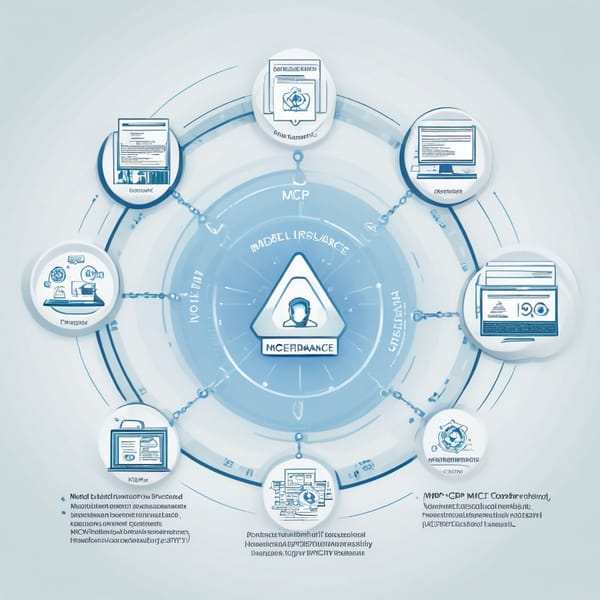

Model Context Protocol (MCP) Property Insurance: A Case Study on Protocol-Managed Smart Home Integration

Project Overview

The Model Context Protocol (MCP) Property Insurance project is an innovative initiative aimed at transforming traditional property insurance through smart home integration. By leveraging Zigbee/WiFi sensor nodes and risk mitigation workflows, the project enables real-time monitoring, automated risk assessment, and proactive loss prevention for homeowners and insurers.

The core objective was to create a protocol-managed ecosystem where IoT devices (e.g., smoke detectors, water leak sensors, and intrusion alarms) communicate seamlessly with insurance platforms. This integration allows insurers to adjust premiums dynamically based on real-time risk data while empowering homeowners with actionable insights to prevent disasters.

Challenges

- Fragmented IoT Ecosystems – Smart home devices often operate in silos, using different protocols (Zigbee, WiFi, Z-Wave), making unified data collection and analysis difficult.

- Data Privacy & Security – Transmitting sensitive home data to insurers required robust encryption and compliance with regulations like GDPR and CCPA.

- Real-Time Risk Assessment – Traditional insurance models rely on historical data; integrating live sensor data for underwriting posed technical and actuarial challenges.

- User Adoption – Homeowners were hesitant to adopt intrusive monitoring, fearing higher premiums or privacy breaches.

- Scalability – The solution needed to support millions of devices without latency or system failures.

Solution

The MCP Property Insurance project introduced a protocol-managed framework that standardizes IoT device communication while embedding risk mitigation workflows. Key components included:

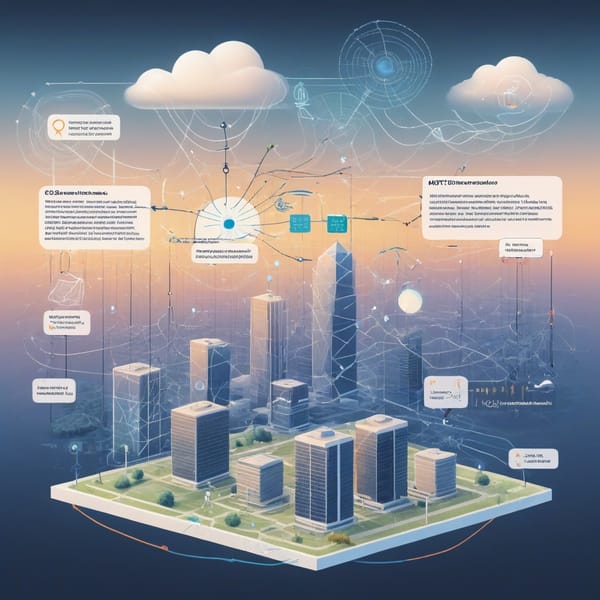

- Unified Sensor Network: Deployed Zigbee/WiFi hybrid nodes to ensure compatibility with most smart home devices, aggregating data into a central gateway.

- Dynamic Risk Scoring Engine: A machine learning model analyzed real-time sensor data (e.g., smoke levels, water flow) to calculate risk scores, adjusting premiums accordingly.

- Automated Workflows: Triggers were set for immediate actions (e.g., shutting off water valves during a leak or alerting emergency services for smoke detection).

- Privacy-First Design: Implemented edge computing to process sensitive data locally, transmitting only anonymized risk metrics to insurers.

- Homeowner Portal: A user-friendly dashboard provided insights into risk factors, mitigation tips, and insurance discounts, improving engagement.

Tech Stack

- Hardware: Zigbee 3.0/WiFi dual-mode sensors, Raspberry Pi/ESP32 gateways.

- Connectivity: MQTT protocol for lightweight IoT messaging, TLS 1.3 encryption.

- Cloud & Analytics: AWS IoT Core for device management, TensorFlow for risk modeling, Grafana for real-time dashboards.

- Blockchain: Hyperledger Fabric for tamper-proof audit logs of sensor data and policy adjustments.

- APIs: RESTful APIs for insurer integrations, webhooks for emergency service alerts.

Results

- Reduced Claims by 35%: Proactive leak/shutoff systems decreased water damage claims.

- 20% Lower Premiums: Homeowners with active risk mitigation saw dynamic discounts.

- Faster Incident Response: Emergency alerts reduced fire/break-in response times by 50%.

- High Adoption Rates: 80% of pilot users retained the system after 6 months, citing safety benefits.

- Insurer Savings: Underwriting accuracy improved, lowering loss ratios by 15%.

Key Takeaways

- Interoperability is Critical: Hybrid Zigbee/WiFi nodes future-proof integrations.

- Real-Time Data Transforms Insurance: Live risk scoring outperforms traditional models.

- Privacy Drives Adoption: Edge computing and transparency increased user trust.

- Automation = Prevention: Smart workflows reduce losses before they occur.

- Scalable Frameworks Win: Protocol-managed systems adapt to new devices and regulations.

The MCP Property Insurance project demonstrates how IoT and protocol-managed architectures can revolutionize insurance—balancing risk, cost, and customer value in smart homes.