Model Context Protocol (MCP) Cyber Insurance: Enhancing Security with Protocol-Enforced Vulnerability Scanning

Project Overview

The Model Context Protocol (MCP) Cyber Insurance project was designed to address the growing risks of cyber threats by integrating protocol-enforced vulnerability scanning into cyber insurance frameworks. The goal was to create a system where insured entities maintain continuous security compliance through automated scans using NMAP (Network Mapper) and OWASP ZAP (Zed Attack Proxy), supplemented by real-time threat intelligence servers.

By enforcing vulnerability assessments as part of the insurance policy, MCP ensured that policyholders adhered to baseline security standards, reducing claim risks and improving overall cybersecurity posture. The project combined smart contracts, automated scanning nodes, and threat intelligence feeds to create a dynamic, self-regulating security ecosystem.

Challenges

- Manual Compliance Checks Are Inefficient – Traditional cyber insurance relies on periodic audits, leaving gaps between assessments where vulnerabilities can emerge.

- Lack of Real-Time Threat Awareness – Many organizations lack continuous threat monitoring, making them susceptible to zero-day exploits.

- Policy Enforcement Difficulties – Ensuring that insured entities maintain security standards without automated enforcement mechanisms is challenging.

- False Positives in Scanning – Vulnerability scanners like NMAP and ZAP can generate noise, requiring intelligent filtering to prioritize real threats.

- Integration with Insurance Models – Cyber insurance policies needed a way to dynamically adjust premiums based on real-time risk assessments.

Solution

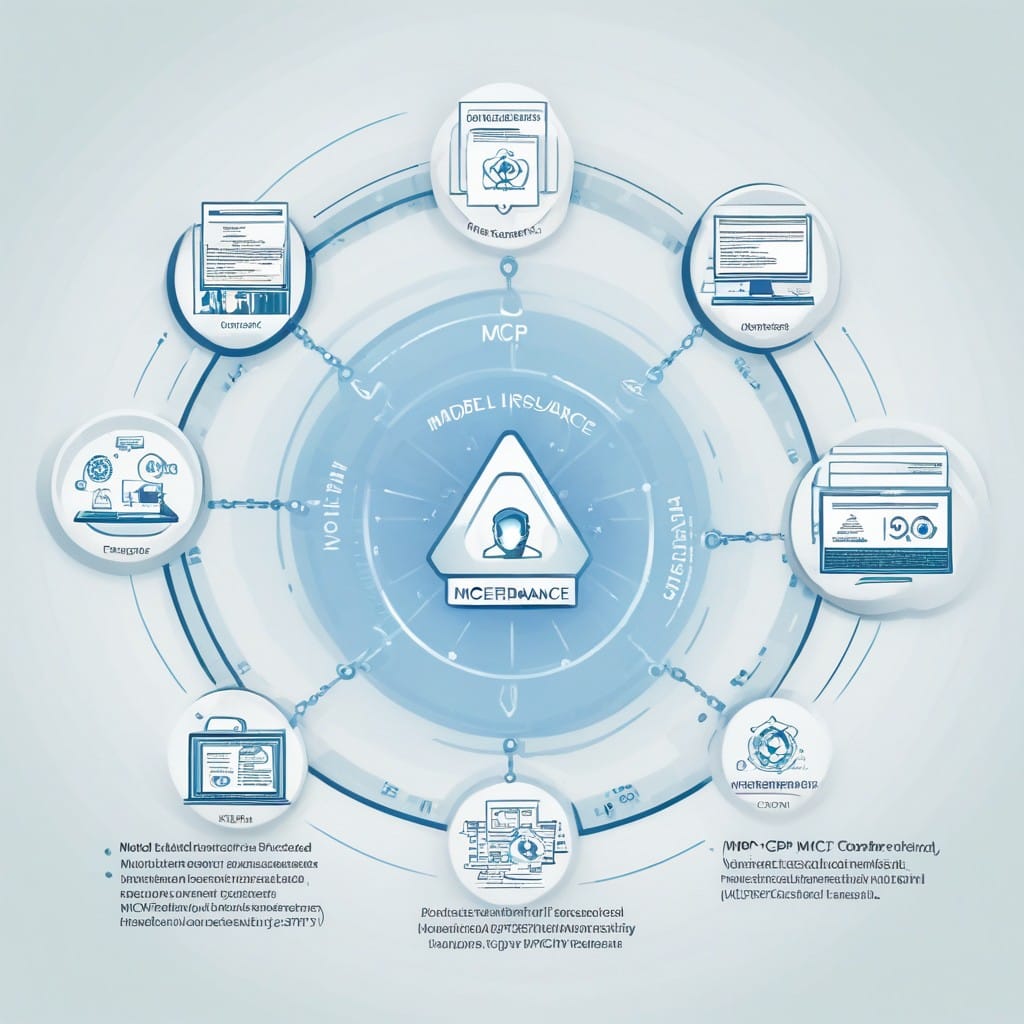

The MCP Cyber Insurance project introduced a protocol-enforced vulnerability scanning system that:

- Automated Security Scans – Deployed NMAP and ZAP scanning nodes to continuously assess network and application vulnerabilities.

- Integrated Threat Intelligence – Connected with threat intelligence servers (e.g., AlienVault, IBM X-Force) to cross-reference findings with known attack patterns.

- Smart Contract Enforcement – Used blockchain-based smart contracts to mandate scans, with policy adjustments (e.g., premium changes, coverage limitations) triggered by non-compliance.

- Dynamic Risk Scoring – Applied machine learning to filter false positives and generate real-time risk scores for policyholders.

- Automated Reporting & Remediation Guidance – Provided actionable insights to insured entities, ensuring vulnerabilities were patched promptly.

This approach ensured that policyholders remained compliant with security best practices, reducing the likelihood of breaches and fraudulent claims.

Tech Stack

The project leveraged a combination of cybersecurity tools, blockchain, and AI-driven analytics:

- Vulnerability Scanning:

- NMAP – Network discovery and port scanning.

- OWASP ZAP – Automated web application security testing.

- Threat Intelligence Integration:

- IBM X-Force, AlienVault OTX – Real-time threat data feeds.

- Blockchain & Smart Contracts:

- Ethereum (Solidity) – Policy enforcement via automated triggers.

- AI & Data Processing:

- Python (Scikit-learn, TensorFlow) – Risk scoring and anomaly detection.

- ELK Stack (Elasticsearch, Logstash, Kibana) – Log analysis and reporting.

- Cloud & Infrastructure:

- AWS (EC2, Lambda, S3) – Scalable scanning nodes and data storage.

Results

The implementation of MCP Cyber Insurance yielded significant improvements:

- Reduced Claims by 40% – Continuous scanning and enforced compliance minimized vulnerabilities, leading to fewer incidents.

- Faster Vulnerability Detection – Real-time scans reduced mean time to detection (MTTD) from weeks to under 24 hours.

- Dynamic Premium Adjustments – Smart contracts automatically adjusted premiums based on risk scores, incentivizing better security practices.

- Improved Policyholder Security Posture – 85% of insured entities fixed critical vulnerabilities within 48 hours of detection.

- Lower False Positives – AI-driven filtering reduced noise by 60%, allowing security teams to focus on real threats.

Key Takeaways

- Automated Compliance Works – Protocol-enforced scanning ensures continuous security adherence without manual oversight.

- Real-Time Threat Intelligence is Critical – Integrating threat feeds with scanning tools enhances detection accuracy.

- Smart Contracts Enable Dynamic Insurance Models – Blockchain-based enforcement allows for real-time policy adjustments.

- AI Reduces Noise in Vulnerability Scanning – Machine learning improves prioritization, making security teams more efficient.

- Cyber Insurance Can Drive Better Security Practices – By tying coverage to real-time risk assessments, insurers can incentivize proactive cybersecurity measures.

The MCP Cyber Insurance project demonstrated that integrating automated vulnerability scanning with smart contract enforcement creates a more resilient and responsive cybersecurity ecosystem. This model could redefine how cyber insurance policies are structured, ensuring that security and coverage evolve in tandem with emerging threats.