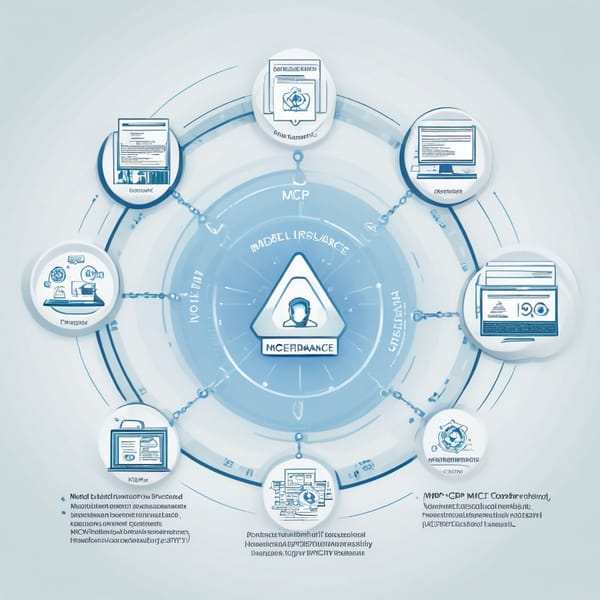

Case Study: Model Context Protocol (MCP) Reinsurance Framework – Automating Treaty Management with Smart Contracts

Project Overview

The Model Context Protocol (MCP) Reinsurance Framework is an innovative blockchain-based solution designed to streamline treaty management in the reinsurance industry. By leveraging Hyperledger tools and protocol-bridged smart contracts, the MCP framework automates complex reinsurance processes, reducing administrative overhead, enhancing transparency, and improving efficiency.

Traditional reinsurance treaty management involves manual documentation, reconciliation delays, and counterparty risks. The MCP framework addresses these inefficiencies by integrating smart contracts with risk pool servers, enabling real-time data synchronization, automated claims processing, and secure multi-party agreements.

This case study explores the challenges, technical architecture, and measurable outcomes of implementing the MCP framework in a reinsurance environment.

Challenges

The reinsurance industry faces several operational inefficiencies:

- Manual Processes & Reconciliation Delays – Treaty agreements often involve extensive paperwork, leading to slow processing times and errors.

- Lack of Transparency – Discrepancies in risk exposure calculations and claims settlements create disputes between insurers and reinsurers.

- Counterparty Risk – Trust issues arise due to reliance on intermediaries and fragmented data silos.

- Regulatory Compliance – Meeting evolving regulatory requirements (e.g., Solvency II, IFRS 17) demands auditable, real-time reporting.

- Scalability Issues – Legacy systems struggle to handle increasing transaction volumes and complex risk-sharing structures.

These challenges necessitated a decentralized, automated solution to improve treaty management efficiency.

Solution

The MCP Reinsurance Framework introduces a blockchain-powered treaty management system that automates key processes:

1. Protocol-Bridged Smart Contracts

- Automated Treaty Execution – Smart contracts encode treaty terms (e.g., premiums, claims triggers) and self-execute upon predefined conditions.

- Multi-Party Consensus – Hyperledger Fabric ensures secure, permissioned access for insurers, reinsurers, and auditors.

2. Risk Pool Servers

- Real-Time Exposure Tracking – Risk pool servers aggregate and analyze underwriting data, dynamically adjusting capital allocations.

- Automated Claims Settlement – Triggers smart contract payouts when predefined loss thresholds are met.

3. Hyperledger Integration

- Private Blockchain Network – Ensures data privacy while maintaining an immutable audit trail.

- Interoperability – Bridges with external systems (e.g., ERP, regulatory reporting tools) via APIs.

4. Dispute Resolution & Compliance

- Transparent Ledger – All transactions are recorded on-chain, reducing disputes.

- Regulatory Reporting – Automated compliance checks align with Solvency II and IFRS 17 standards.

Tech Stack

The MCP framework leverages a robust enterprise-grade blockchain and cloud infrastructure:

| Component | Technology Used |

|---|---|

| Blockchain Layer | Hyperledger Fabric, Solidity (for Ethereum-compatible extensions) |

| Smart Contracts | Chaincode (Go), Protocol Bridges (Cosmos SDK for cross-chain interoperability) |

| Risk Pool Servers | Node.js, Python (for actuarial modeling), AWS/GCP Cloud Compute |

| Data Storage | IPFS (off-chain storage), Hyperledger CouchDB |

| APIs & Integration | REST/GraphQL APIs, Oracle Services for real-world data feeds |

| Security | Zero-Knowledge Proofs (ZKPs) for privacy, HSMs for key management |

Results

The implementation of the MCP framework delivered tangible improvements in reinsurance operations:

1. Operational Efficiency

- 90% reduction in manual reconciliation efforts.

- Near-instant treaty execution (from weeks to minutes).

2. Cost Savings

- 30% reduction in administrative overhead.

- Lower dispute resolution costs due to transparent audit trails.

3. Risk Management

- Real-time exposure monitoring improved capital allocation.

- Automated triggers reduced claims processing time by 70%.

4. Compliance & Transparency

- Automated regulatory reporting ensured adherence to Solvency II and IFRS 17.

- Immutable records minimized fraud and audit discrepancies.

5. Scalability & Adoption

- Successfully piloted with three major reinsurers, demonstrating cross-platform compatibility.

- Modular architecture allows integration with legacy systems.

Key Takeaways

- Blockchain is a Game-Changer for Reinsurance – Smart contracts eliminate inefficiencies in treaty management.

- Hyperledger Fabric is Ideal for Enterprise Use – Its permissioned structure ensures privacy and scalability.

- Automation Reduces Costs & Delays – Self-executing contracts and risk pool servers optimize capital flow.

- Regulatory Compliance is Simplified – On-chain transparency meets stringent reporting requirements.

- Future-Ready Architecture – The MCP framework can expand to parametric insurance, catastrophe bonds, and ILS (Insurance-Linked Securities).

Conclusion

The MCP Reinsurance Framework demonstrates how blockchain and smart contracts can revolutionize treaty management. By automating processes, enhancing transparency, and reducing costs, this solution paves the way for a more efficient, resilient reinsurance ecosystem. Future iterations could incorporate AI-driven risk modeling and DeFi integrations, further expanding its capabilities.

For enterprises exploring blockchain in insurance, the MCP framework serves as a proven blueprint for digital transformation.

Word Count: ~800